Kangaroo Kronicles 29 – Making Big Bucks with Warehouses – Part IV

Saturday, October 8, 2011 By Stu Silver ·0

Kangaroo Kronicles 29 – Making Big Bucks

with Warehouses- Part IV

By

“Uncle Zally” / Stu Silver

________________________________________

Hey I’m back in Israel !

Hey I’m back in Israel !

Wish I had a large cup of Peruvian coffee beside me, but on this hilltop all I can get is some weak tea.

For the last two nights, our Arab cousins were partying Palestinian Style. There were loudspeakers blaring Middle-Eastern music throughout the valley, punctuated by blasts from AK-47’s. It’s a tossup as to which is more “spiritual”, a Paralounge Drum Festival going on across the lake in the Ocala National Forest, or belly dancing music and gunfire.

For the previous three blogs, I discussed another housing investment I feel passionate about, ware–housing, and we coined a new phrase together: “Warehouses are the big boxes that spit out money.”

In the first blog, I showed you, in 2011 D.R. – During Recession – the process of how to figure out what you could pay for a warehouse today, that would give you at least a 10% return, and a fantastic return A.R. in a N.E., After Recession in a Normal Economy.

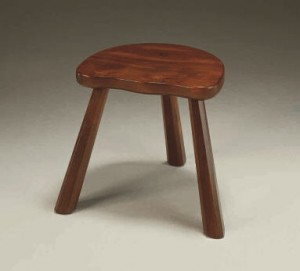

In the second blog, I took Uncle Zally’s 3 legged stool for business excellence out for a spin:

In the second blog, I took Uncle Zally’s 3 legged stool for business excellence out for a spin:

1- Excellence in your product or service

2- Excellence in the management of the business and people

3- Excellence in marketing

We discussed the first leg, excellence in the warehouse product, by discussing the most popular size, and amenities, your customers, i.e. your tenants, desired.

In the next blog, we discussed the second leg, excellence in managing your business – maintaining buildings and keeping tenants happy. Luckily, managing warehouse tenants is not time intensive, labor intensive, or aggravation intensive. If you are used to residential tenants, it’s okay at this point to sing the great spiritual, “Free at Last, Great God Almighty, Free at Last!”

In this article, the final one in this series, we will discuss marketing. This means finding customers – tenants – and then qualifying them.

Finding tenants for warehouses has changed dramatically in the last three years.

Previously, all we needed, in order of importance, was:

1- a classified ad in the local paper

2- a sign out front of the property

3- maybe a listing in MLS.

Now, in order of importance, we need:

1- an ad in CraigsList

2- a sign in front of the property

3- a listing on LoopNet

4- maybe a listing in CoStar

5- maybe a classified ad in the local paper

6- maybe a listing in MLS

For small warehouse spaces, CraigsList supplies 90% of our new tenants. That’s right, 90%! And the more pictures, the better.

For small warehouse spaces, CraigsList supplies 90% of our new tenants. That’s right, 90%! And the more pictures, the better.

For bigger spaces, Loopnet, and then CoStar come into play. And once again, the more pictures, the better.

A classified ad and a listing in MLS have become almost irrelevant, based upon the phone calls we receive. We still advertise in those 2 spots, but we are disappointed in the results.

Once you get a prospective warehouse tenant, you must qualify them. As I said in the previous blog, investing in warehouses is not like selling hamburgers, where anyone can qualify for a Big Mac as long as they have a couple of bucks. When you are putting someone in a property you own that costs tens of thousands, hundreds of thousands, or even millions of dollars, you don’t want it trashed. Just because someone has the money for rent today does not mean you should rent to them.

Once you get a prospective warehouse tenant, you must qualify them. As I said in the previous blog, investing in warehouses is not like selling hamburgers, where anyone can qualify for a Big Mac as long as they have a couple of bucks. When you are putting someone in a property you own that costs tens of thousands, hundreds of thousands, or even millions of dollars, you don’t want it trashed. Just because someone has the money for rent today does not mean you should rent to them.

You must be like Clint Eastwood in “Million Dollar Baby” and protect yourself at all times. That means running credit checks on the principles of the business, and getting their personal guarantees on the lease. It also means getting first month’s rent, last month’s rent, and a security deposit.

We see three kinds of tenants today:

1- New Businesses

2- Businesses that are downsizing or upsizing

3- Existing businesses from other areas looking to expand

The statistics on new businesses are, I believe, 1 out of 3 survive. Therefore, you have to be very careful. We have rented to new businesses that disappeared a few months later. This has happened more than once.

We get most of our calls from businesses that are downsizing – looking to lower their overhead, specifically their rent, so they can “batten down the hatches” and survive this nasty recession. Occasionally we get someone who is upsizing, whose business is successful, and they need more space, but those calls are rare.

The best prospective tenants we see are successful businesses located outside our area, who are now looking to expand into our market. They are typically better capitalized, and have a proven business model. We compete aggressively for their business.

That concludes our discussion of warehouse investing.

That concludes our discussion of warehouse investing.

Tune in next week to see what is in store for you at The Kangaroo Kronicles.

Until then, Cheers, Mate!

-

-

Filed under Articles · Tagged